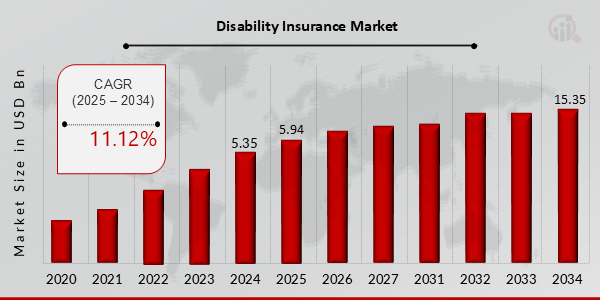

Disability Insurance Market to Observe Highest Growth of USD 15.35 billion with Growing CAGR of 11.12% by 2034

Disability Insurance Market Growth

Disability Insurance Market Research Report By, Product, Coverage Type, Benefit Period, Premium Payment Term, Distribution Channel, Regional

NE, UNITED STATES, April 14, 2025 /EINPresswire.com/ -- The Global Disability Insurance market has experienced substantial development in recent years and is expected to witness accelerated growth in the coming decade. In 2024, the market size was valued at USD 5.35 billion and is projected to grow from USD 5.94 billion in 2025 to an impressive USD 15.35 billion by 2034, registering a compound annual growth rate (CAGR) of 11.12% during the forecast period (2025–2034). The surge in workplace safety concerns, increasing awareness about income protection, and rising incidences of disabilities are key drivers fueling market expansion.

Key Drivers of Market Growth

Rising Awareness of Income Protection Solutions

As individuals and families become more conscious of financial risks posed by sudden disabilities, the demand for income replacement through disability insurance has increased significantly. This trend is supported by aggressive awareness campaigns and improved product offerings.

Growth in Workforce Participation and Employer-Sponsored Benefits

With growing global workforce participation, especially among younger demographics, employers are increasingly offering disability insurance as part of comprehensive employee benefits packages. Group disability plans are gaining popularity due to their cost-efficiency and wide coverage.

Increasing Incidence of Chronic Illnesses and Workplace Injuries

A rising prevalence of chronic diseases and workplace-related injuries has led to a surge in long-term and short-term disability claims. The growing need for financial support during recovery periods is contributing to the expansion of the disability insurance market.

Government and Regulatory Support

Governments across developed and emerging economies are promoting disability coverage through policy initiatives, tax incentives, and public-private partnerships. These efforts aim to improve financial inclusion and provide social safety nets for vulnerable populations.

Technological Advancements in Policy Administration

Digital platforms, automation in claims processing, and AI-powered risk assessment tools are streamlining operations in the disability insurance sector. These innovations are reducing turnaround times, enhancing customer experience, and increasing insurer profitability.

Shifting Demographics and Aging Population

The growing aging population, particularly in countries like Japan, Germany, and the U.S., is expected to boost the demand for disability insurance, as older adults are more susceptible to disabling conditions that impact their income-generating capabilities.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/24114

Key Companies in the Global Disability Insurance Market Include

• Zurich Insurance Group

• Sun Life Financial

• The Standard

• Allianz

• MassMutual

• Aflac Incorporated

• Prudential Financial

• Manulife Financial

• MetLife

• Guardian Life Insurance Company of America

• AIG

• Principal Financial Group

• The Hartford

• GreatWest Lifeco

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/disability-insurance-market-24114

Market Segmentation

To offer an in-depth perspective, the Global Disability Insurance market is segmented based on type, coverage, end-user, and region.

1. By Type

• Short-Term Disability Insurance: Covers temporary disabilities, usually for a few months, offering immediate income replacement.

• Long-Term Disability Insurance: Provides extended financial support for serious disabilities that prevent individuals from working for a prolonged period.

2. By Coverage

• Individual Disability Insurance: Purchased independently by policyholders to protect their personal income.

• Group Disability Insurance: Offered by employers as part of employee benefits, often with lower premiums and broader access.

3. By End-User

• Salaried Employees: Coverage for income replacement in case of illness or injury that prevents continued employment.

• Self-Employed Individuals: Customizable policies designed to protect independent professionals and entrepreneurs.

• High-Risk Occupations: Includes workers in construction, manufacturing, and healthcare sectors with elevated risk of disability.

• Retirees and Senior Citizens: Specialized products catering to the unique needs of aging individuals prone to chronic health issues.

4. By Region

• North America: Dominates the market with high penetration of employer-sponsored plans and strong consumer awareness.

• Europe: Growth driven by social insurance programs and increasing demand for supplemental private coverage.

• Asia Pacific: Emerging market with rising disposable income and improving awareness of financial risk protection.

• Latin America: Expanding due to increased urban workforce and supportive government reforms.

• Middle East and Africa: Nascent market with untapped potential as insurance literacy improves.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24114

The Global Disability Insurance market is on a trajectory of sustained growth, driven by greater consumer awareness, changing workforce dynamics, and technological innovation. As the need for income protection continues to rise, insurers are expected to expand their offerings and enhance digital capabilities to meet evolving customer needs and regulatory standards.

Related Report:

banking wearable market

banknote market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release