C-Suite Outlook 2025: Seizing the Future

Key Insights

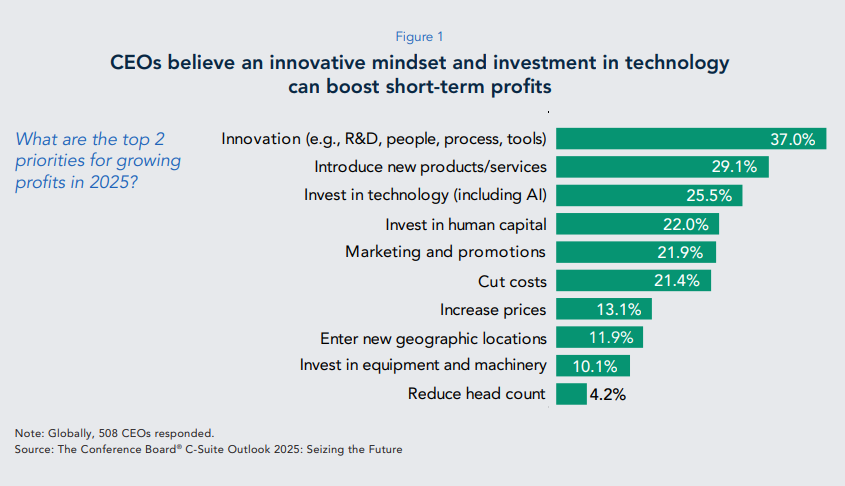

- CEOs globally continue to focus on growth in 2025 despite material challenges and risks ahead. CEOs rank innovation, introducing new products and services, and investing in technology (including AI) as their primary strategies for growing profits, and they desire leaders who are innovative thinkers to drive future growth.

- CEOs cite the rapid advancement of AI technology, rising geopolitical tensions (particularly between the US, EU, and China), a slowing global economy, regulatory burdens, and sustainability demands as the high-impact external factors their organizations face in 2025.

- Close to half of CEOs consider intensified trade wars to be the leading conflict-related geopolitical business risk in 2025, followed by foreign cyber attacks and an increased risk of conflict in Asia-Pacific, issues directly related to concerns over rising tensions between the US, EU, and China.

- Global political instability, lessons from the pandemic-era disruptions, and the threat of escalating trade tensions have created renewed urgency around the need for supply chain resilience. Globally, 78.3% of CEOs plan to alter their supply chains over the next three to five years, led by Asia and followed by Europe (i.e., France, Germany, Italy, the UK, and a small number of respondents from other economies) and the US.

- CEOs’ primary motivations for altering supply chains are risk reduction, cost reduction, proximity to customers, and the greening of supply chains.

- Higher energy prices are cited as the top economy-related geopolitical risk for CEOs globally (34.6%), and especially in Japan (47.2%) and Europe (46.9%). Still, more than half of US CEOs (51%) cite the size of the US national debt as their chief economy-related geopolitical risk.

- Fear of an economic downturn/recession continues to linger, with 45.7% of CEOs globally identifying it as a high-impact issue. While The Conference Board expects economic growth in both emerging and mature economies to slow in the near term, we do not believe there is immediate risk of a global recession. However, reducing costs is the first or second internal focus area for CEOs in every country and region.

- Labor shortages, higher labor costs, and demographic changes are also considered high-impact issues by CEOs—notably in Japan, where 66.3% of CEOs expect labor shortages, 47.2% expect higher labor costs, and 42.7% expect demographic changes to have a significant impact on operations.

- Regarding attracting and retaining talent, which is a focus of CEOs given labor shortages, Japan and Europe rank this as their top internal human capital issue, while the US ranks it among the top three concerns.

- Accelerating digital transformation, including AI, is a top internal priority for CEOs globally in 2025, especially for CEOs in Japan, Europe, and the US. Indeed, more than a third of CEOs globally and in the US and Asia expect rapidly advancing AI technology to be an organizational game changer in 2025. Europe is not far behind at 25.8%. CEOs say the most significant AIrelated improvements in performance have been in workforce productivity, customer satisfaction, and innovation.

- However, many organizations are struggling to integrate AI into their operations. Lack of expertise, integration with existing systems, and the quality of AI output are the top implementation challenges identified by CEOs. The survey also reveals a perception gap between CEOs and other C-Suite executives when it comes to identifying the main obstacles to AI implementation, indicating a need for alignment within the C-Suite to overcome AI challenges.

- CEOs and other C-Suite executives globally identify sustainability, climate risk, and regulation and disclosure requirements as their top high-impact ESG issues for 2025. The environmental priorities they intend to focus on include renewable energy and carbon neutrality, while social priorities include economic opportunity and education.

- Notably, CEOs in “Other Asia” (i.e., China, India, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and a small number of respondents from other economies) see their organization’s investment in the energy transition as a key priority.

CEOs Eye Innovation, Investments, and Tech to Grow Profits

CEOs globally continue to focus on growth in 2025 despite material challenges and risks ahead. They also prioritize finding opportunities amid uncertainty, volatility, and tectonic shifts.

Given these priorities, CEOs rank innovation, introducing new products and services, and investing in technology (including AI) as their primary strategies for growing short-term profits. Notably, accelerating digital transformation, including AI, is also a top internal priority for 2025, especially for CEOs in Japan, as well as CEOs in Europe and the US.

A total of 21.4% of CEOs globally and 31.7% in Europe intend to cut costs to improve the bottom line, while 13.1% globally and 25.8% in Japan plan to increase prices. Despite extended battles with inflation in recent years, only 11.3% of CEOs in the US and 10.5% in Europe plan to raise prices.

To support their profit growth strategy, 36.7% of CEOs say they plan to increase their marketing budget by 10% or more on AI and data analytics, and more than a quarter (26.8%) on new product development. Additionally, CEOs understand that investing in human capital will be critical to help their companies weather external risks, achieve internal goals, and transform their businesses for long-term growth.

A link to the full report can be found here.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release