- India

- International

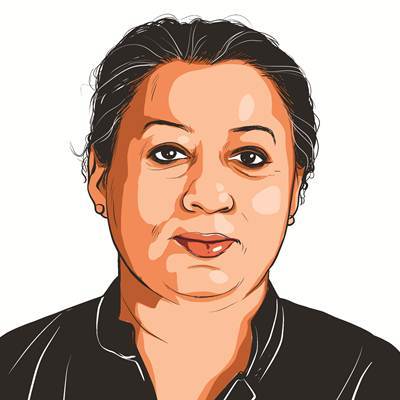

Panama Papers: Have begun verifying new data, says CBDT chief Sushil Chandra

Panama Papers: CBDT Chief Sushil Chandra said, “We have taken invasive action in 62 cases connected to Panama Papers and have found that large deposits had been made in foreign bank accounts which had not been declared in tax returns or surrendered during the amnesty scheme."

Sushil Chandra told The Indian Express that within hours of the fresh revelations, “initial verification” of the new names and details had already begun.

Sushil Chandra told The Indian Express that within hours of the fresh revelations, “initial verification” of the new names and details had already begun.

On the day The Indian Express published details of a new set of Panama Papers linking Indians to offshore entities in tax havens, tax authorities in India responded, promising “prompt investigations” into revelations and leads from the tranche of 11.2 million documents connected to Panamanian law firm Mossack Fonseca.

Sushil Chandra, Chairman of the Central Board of Direct Taxes (CBDT), heading the joint team probing the Panama Papers, told The Indian Express that within hours of the fresh revelations, “initial verification” of the new names and details had already begun.

READ | New data shows ex-Delhi politician was introduced to Mossack by Swiss bank

“New documents will also be examined in a reasonable time-frame and initial verification has already started… we are already trying to complete investigations in as many cases of Panama Papers as possible within the current assessment year, and many under the black money Act,” he said.

READ | Despite global leak, this Indian client didn’t want Mossack Fonseca to quit

He said that in a large number of cases of persons named as owners or officers of offshore companies incorporated by Mossack Fonseca, the probe team found that assets owned by these companies, or investments made via them, had not been declared or surrendered during the period of the black money amnesty scheme announced by the NDA government.

The CBDT also issued a statement Thursday in which it pegged the detection of undisclosed foreign investments at Rs 1,140 crore.

Panama Papers: Click for full coverage

“We have taken invasive action in 62 cases connected to Panama Papers and have found that large deposits had been made in foreign bank accounts which had not been declared in tax returns or surrendered during the amnesty scheme. These bank accounts have been traced by us after the publication of the first tranche of the Panama Papers, after the foreign jurisdiction concerned has supplied us with balance sheets and details of the entity, and after we have combined this with our own intelligence from various units,” Chandra said.

READ | Month after expose, Prithvi Raj Singh Oberoi quit Bahamas company

Underlining that in 16 cases of Panama Papers, criminal prosecutions had already been filed in different courts of the country and notices under Section 10 of the black money Act had been issued in 32 cases, he said this was evidence that the CBDT acted with speed. “We will continue doing so and the new details and batches of documents will be scrutinised by us similarly,” he said.

READ | After red flag, law firm moved to resign from companies tied to arms agent’s son

The CBDT release too stated: “The fresh release made in the media today under Panama Papers leaks is being promptly looked into by the law enforcement agencies under the aegis of the Multi Agency Group (MAG) already constituted for coordinated and speedy investigation…”

READ | Offshore firms linked to DLF family got reminders — Send due diligence papers KPSingh

It also updated figures for the entire batch of Panama Paper cases: 426 people had been investigated by the Income Tax Department and other member agencies of MAG, and of these, 74 cases had been found actionable. In all, searches and surveys in 62 cases have already been conducted.

Apr 26: Latest News

- 01

- 02

- 03

- 04

- 05